Bingley sent me this interesting little email he got yesterday.

Seemed noteworthy at the time, but there wasn’t a lot of information besides what was actually IN the announcement itself.

The government’s Commodity Futures Trading Commission (CFTC) regulates the commodities and derivatives markets. Their mission statement…

The mission of the Commodity Futures Trading Commission is to promote the integrity, resilience, and vibrancy of the U.S. derivatives markets through sound regulation.

…and the little snippets of history on the webpage…

Futures contracts for agricultural commodities have been traded in the United States for more than 150 years and have been under Federal regulation since the 1920s. When the CFTC was created in 1974 with the enactment of the Commodity Futures Trading Commission Act, most futures trading took place in the agricultural sector. Over the years, the futures industry has become increasingly varied and complex

…give the novice a basic idea of what their function is and what kind of things theCFTC ‘regulates.’

There’s also what should be a pretty familiar popular reference available for folks to have an ‘Ah-HA!‘ moment, which had to do with orange futures.

It’s one thing when kingpins – or duckpins – like the fictional Dukes try to corner the market on a future, but it’s another thing entirely to see something pop up that puts the regulators themselves in a questionable light.

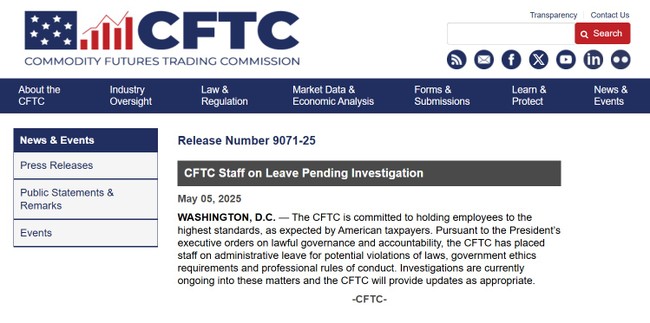

This last bit of the press release certainly did that.

…the CFTC has placed staff on administrative leave for potential violations of laws, government ethics requirements and professional rules of conduct. Investigations are currently ongoing into these matters and the CFTC will provide updates as appropriate.

What sort of hanky-panky was going on, and how did they find it?

A little more information was forthcoming today from other sources as various people in the know began digesting the news.

…Acting CFTC Chairman Caroline D. Pham responded to the CFTC Office of Inspector General’s (OIG) findings regarding telework violations by a staff member, expressing concern over what she described as “a lengthy scheme to defraud the American taxpayer.” Pham criticized previous management for failing to act and stated her administration promptly referred the case to the OIG for independent investigation. The OIG substantiated multiple allegations, including criminal violations and false sworn statements, and Pham commended the investigators for their thorough and impartial work in exposing the misconduct.

There have also been statements released from the CFTC itself now further clarifying the issue.

According to Caroline D. Pham, who had been a CFTC commissioner since 2022 and then tapped by President Trump to be the acting Chairman in January, it appears to have nothing to do with cattle or coffee futures.

Instead, it is a teleworking fraud scheme that she uncovered and sent to their Inspector General to investigate.

“While I’m disturbed by the many accounts of serious misconduct by former union leadership in this report —including a lengthy scheme to defraud the American taxpayer over many years that previous management failed to address appropriately—I’m relieved that the OIG was able to promptly shine a light on these matters to ensure accountability,” Acting Chairman Pham said. “My team became aware of an administrative review of these matters upon taking office in January and immediately asked the OIG to take the lead to avoid any conflicts and ensure independence. The OIG substantiated multiple allegations of wrongdoing, some of which involved criminal violations of law. I’m particularly troubled by the many false statements made under oath to the OIG, and I applaud the diligent work of the investigators to sort out fact from fiction.”

Still no clarification on how many staff members are on leave (the statement did say ‘members’ in the plural), but there’s at least one, and it’s a pretty brazen example of a work-from-home rip-off.

It turns out the CFTC ‘Risk Analyst‘ in question was nowhere near the Chicago regional office they were assigned to (coincidentally, where the Chicago Board of Trade is located, go figure).

In fact, the IG inspector’s investigation proved this employee wasn’t even in the country, for crying out loud.

But collecting their paychecks, etc., and running US government business out of God-knows-where as if they were in an apartment in Poughkeepsie. Schweet.

In January 2025, Commodity Futures Trading Commission (CFTC) Office of Inspector General (OIG) opened an administrative investigation into allegations that a Risk Analyst (CT-1101-14) assigned to the Chicago Regional Office was teleworking from outside the United States in violation of CFTC telework policy. During the investigation, OIG identified multiple emerging allegations to include timekeeping misconduct, false or misleading statements under oath, administrative leave violations, and prohibited political activity under the Hatch Act. All allegations and specifications were substantiated by preponderant evidence.

Trump’s ‘return to office’ order had to be a bitch, no?

The interesting reference Chairman Pham made regarding the union leadership’s part in facilitating this fraud might also turn out to be uncomfortable for those folks, considering the seriousness of the violations listed in the IG report. Chairman Pham does say ‘criminal violations of the law’ in her official statement and ‘members’ of the staff have been put on administrative leave.

Could be a serious house cleaning coming.

First of all, I’d like to send kudos to Chairman Pham and her IG team for snagging this right off the bat, but I have to hand it to President Trump and his team once again.

They have really picked some terrific people to hold these jobs. The ways it’s been paying off, large and small, almost immediately, is nothing short of amazing to behold in a town as rotten to the core as D.C. and a bureaucracy as sclerotic as the federal government’s.