I recently wrote about the salaries the ‘charity’ Unicef UK pays its head honchos.

Here are some of the figures, including benefits:

1 Jonathan Sparkes, Executive Director – £184,493

2 Steven Waugh, Chief Financial Officer – £153,447

3 Mohini Raichura-Brown, Deputy Executive Director, Partnerships and Philanthropy – £150,085

4 Joanna Rea, Interim Deputy Executive Director for Advocacy, Programmes and Safeguarding – £145,072

The packages of around £140,000 to £150,000 are par for the course for the bosses of major charities. However Unicef UK employees are classed as UN staff and so don’t pay income tax. Any taxpaying UK citizen would have to earn around £250,000 to get a salary similar to the money paid to Unicef UK’s top executives.

Following my blog, a reader wondered how much of our major charities’ income actually comes from governments (aka our taxes – thus forced donations) compared with voluntary donations. I covered this in my 2015 book The Great Charity Scandal.

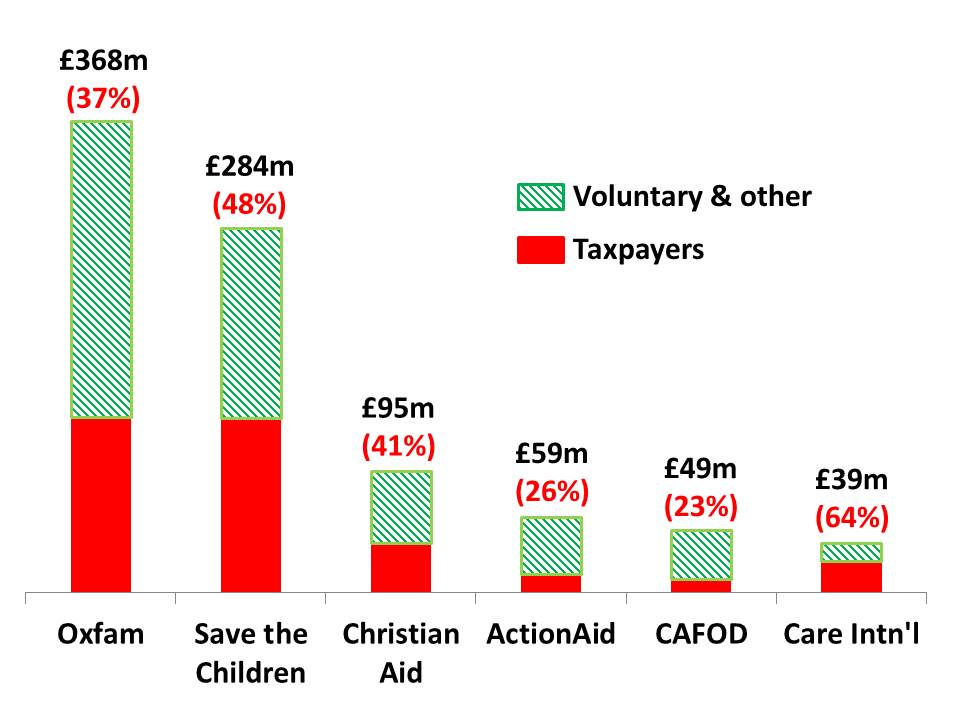

I’m not a bean-counter. But looking at the financial accounts of a few major anti-poverty charities when I wrote my book, I concluded that in 2014:

- Oxfam got around £137million milked from taxpayers, which was 37 per cent of its £368million income;

- Save The Children got just under £137million from taxpayers, 48 per cent of its £284million income;

- Christian Aid received £39million from our taxes, 41 per cent of its £95million income.

That was around ten years ago. So I thought I’d check if anything has changed since then. I tried to look at Oxfam. But there was something odd about the most recent financial accounts the charity submitted to the Charity Commission. They were a few days late, which was unusual. Moreover, instead of the typical annual report – a 100+ page self-adulatory full-colour panegyric to Oxfam’s wonderful contribution to the well-being of mankind, there were a whole lot of almost illegible pages which looked as if they’d been hurriedly photocopied by a drunken chimpanzee. Though I did notice that £123.4million of Oxfam’s total £368million income (33.5 per cent) was spent generating the £368million income. That’s terrible. The Charity Commission regularly claims that only around 10 per cent of most charities’ income is spent generating funds. Anyway, as I couldn’t read much of Oxfam’s financial accounts, I went to the next ‘charity’ on the above chart, Save The Children.

From what I can gather, Save The Children UK’s most recent accounts showed a total annual income of £296,015,000. Of this amount, £158,123,000 (53 per cent) came from what are called ‘Government and Multi-lateral Organisations’. This category may include some voluntary donations, but it will be mostly our tax money. So it could seem that little has changed since I wrote The Great Charity Scandal (available from Amazon for just over a fiver). In fact, the percentage of Save The Children’s income from government money has increased slightly from 48 per cent in 2014 to 53 per cent of its total income in 2024.

In my book, I called these charities the ’Double Dippers’ as they get huge amounts of our money from our taxes and even more from voluntary donations. Furthermore, I suggested that many of these charities are rather coy about the incredible amounts of our tax money they manage to get their hands on. After all, if a charity like Save The Children were to do an ad saying something like ‘We already get £158,123,000 from your taxes, but we’d still like you to give us more of your hard-earned, heavily-taxed money to save all the world’s poor starving children’, I hardly think most of us would be enthusiastic about donating.

We have more than 200,000 registered charities in Britain – one charity for every 325 citizens – and many thousands more which aren’t registered because their annual income is less than £25,000. Over a million people are employed by these 200,000+ charities. Whatever your passion – starving children, cancer sufferers, cats, hedgehogs, donkeys etc etc – you can find multiple charities all desperately keen to receive generous amounts of your money for their chosen cause. Having so many charities leads to stupendous amounts of duplication, triplication, quadruplication of spending and thus massive amounts of waste. And it seems that many charities mainly to benefit the founders.

When researching my book, I found numerous charities which looked more like self-enrichment schemes than philanthropic enterprises. For example, one spent just over £43,000 on charitable activities in one year while giving consultancies owned by the charity’s founders around £90,000 of donors’ money each. Other ‘charities’ paid large amounts renting office space in the founders’ homes and/or employed members of their founders’ families. We all remember the questionable issues around the Captain Tom charity.

I believe the massive charity industry is completely out of control and that if the Charity Commission and the Scottish and Northern Irish charity regulators had any cojones, they would set a limit of, say, 10,000 charities for the whole of the UK and force more than 190,000 ‘charities’ to merge or close down.

Personally, I try to donate my money to small local charities run by volunteers and steer well clear of the multi-million-pound outfits with their legions of highly paid executives, big expense accounts, luxury travel arrangements and self-promotion budgets.