ONLY this Labour Government could reduce the fines on carmakers for selling the wrong kind of car from £15,000 per vehicle to £12,000 and call it supporting the car industry!

Under pressure to hit EV targets, the industry has been selling electric cars at unsustainable discounts whilst restricting sales of petrol/diesel vehicles. If that was not bad enough, they are also faced with fines of £12,000 for every one of the latter they sell above their quota.

This year the Government says 28 per cent of car sales must be pure electric; so far sales are stuck at 20.7 per cent, barely above last year’s figure. As most drivers refuse to buy cars that are not fit for purpose, carmakers are stuck between a rock and a hard place.

They were promised a review of what is known as the Zero Emission Vehicle (ZEV) mandate last autumn by Jonathan Reynolds, Labour’s Business Secretary, and it has has just been published. They will be sorely disappointed. Strip away the waffle, greenwash and gaslighting, and we are left with rearranging the deckchairs on the Titanic to a higher deck, so that they don’t sink below the waves quite as soon!

Sale of new petrol and diesel cars will still be banned from 2030, and the ZEV annual targets will remain unchanged – 28 per cent this year, rising to 80 per cent in 2030. Hybrid cars will be allowed to make up the remaining 20 per cent, but this was already the official policy. Hybrids are in any event a dead-end technology – as they will be banned after 2035, who will spend billions on developing them in the meantime?

The only sop in this new package is to allow carmakers who fall below the ZEV target to ‘borrow’ allowances, which they can offset against surpluses in future years up to 2030. Building up debt in this way would be the equivalent of a payday loan. If Ford, for instance, cannot hit this year’s 28 per cent mandate, what chance do they have of meeting next year’s target of 33 per cent?

The simple fact is that EVs remain unaffordable for most drivers. For instance, the new Kia EV3, a compact SUV, retails at £33,005 for the basic model, more than £11k dearer than Kia’s petrol equivalent.

I predict that carmakers will be so far below their ZEV targets in two or three years that they will simply shut down production lines for many petrol vehicles to bring the ratio back in line and avoid fines. And if you want to buy a new petrol car then, you can forget about it.

Climate change will destroy capitalism!

ACCORDING to the Guardian, capitalism will be destroyed by climate change and extreme weather. An article by their Environment Editor, Damian Carrington, claimed:

‘The climate crisis is on track to destroy capitalism, a top insurer has warned, with the vast cost of extreme weather impacts leaving the financial sector unable to operate.

‘The world is fast approaching temperature levels where insurers will no longer be able to offer cover for many climate risks, said Günther Thallinger, on the board of Allianz SE, one of the world’s biggest insurance companies. He said that without insurance, which is already being pulled in some places, many other financial services become unviable, from mortgages to investments.

‘The core business of the insurance industry is risk management and it has long taken the dangers of global heating very seriously. In recent reports, Aviva said extreme weather damages for the decade to 2023 hit $2tn, while GallagherRE said the figure was $400bn in 2024. Zurich said it was “essential” to hit net zero by 2050.’

Read the full story here.

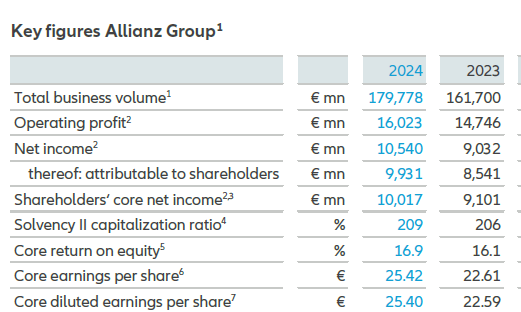

Meanwhile in the real world, Allianz are doing very well, thank you! All of these supposed weather disasters have not made a dent in profits.

https://www.allianz.com/en/investor_relations/results-reports/annual-reports.html

Operating profits increased to £16billion last year, a margin of 9 per cent of premiums.

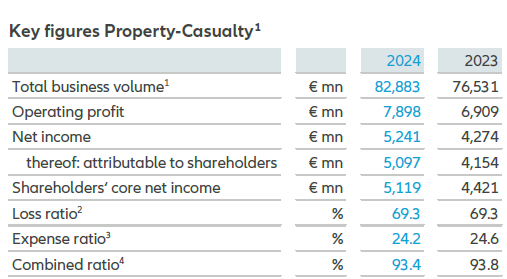

Taking away the Life Business, the Property and Motor Division still accounted for over half the total profit.

The insurance business is all about the quantification of risk, which then leads to the setting of premiums. If risks increase, for whatever reason, premiums rise in line; the insurer over time continues to make his margin.

Some things may become uninsurable, a house built on a flood plain, for instance. That’s tough luck for the homeowner, but the house should clearly never have been built there.

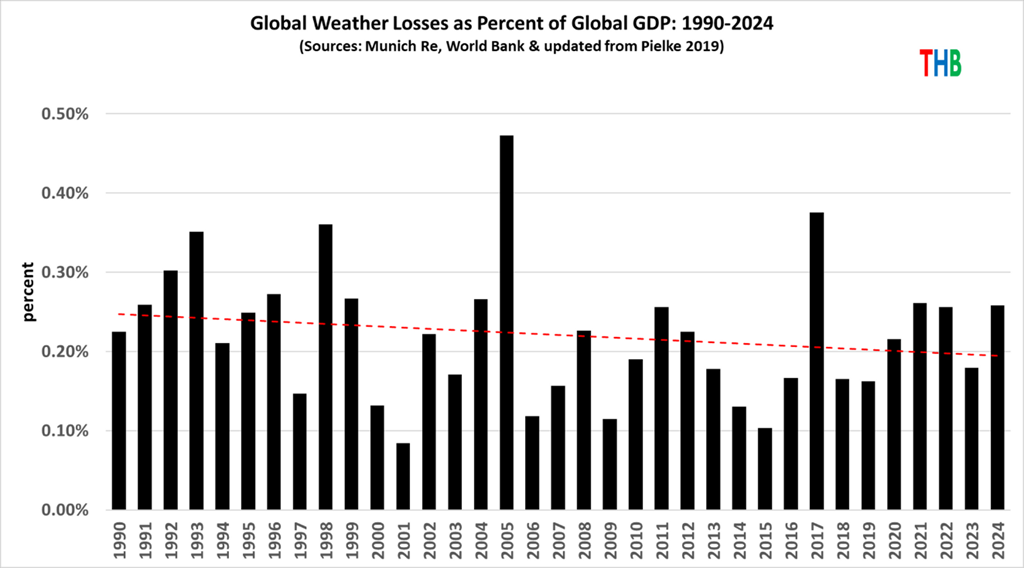

In overall terms weather losses have been falling in real terms as a proportion of GDP, as Professor Roger Pielke Jr shows below:

Given that the world’s GDP is estimated at $106trillion, Pielke’s figures suggest weather losses of about $200billion a year, in line with the $2trillion quoted by Aviva for the decade to 2023.

The Guardian would like its readers to believe that such numbers are catastrophic and unaffordable for the insurance industry. In reality it is just business as usual.

But what better way to push up premiums than to play the climate card!