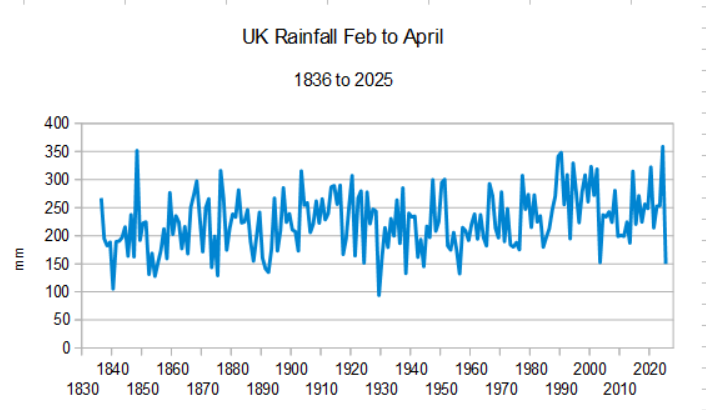

We are headed for one of the sunniest and driest springs on record in the UK. In fact the dry weather began in February – we have had the driest February to April period since 1956. No doubt it will end up being blamed on climate change, but as the chart below shows, several other years such as 1840 and 1929 were much drier for those three months:

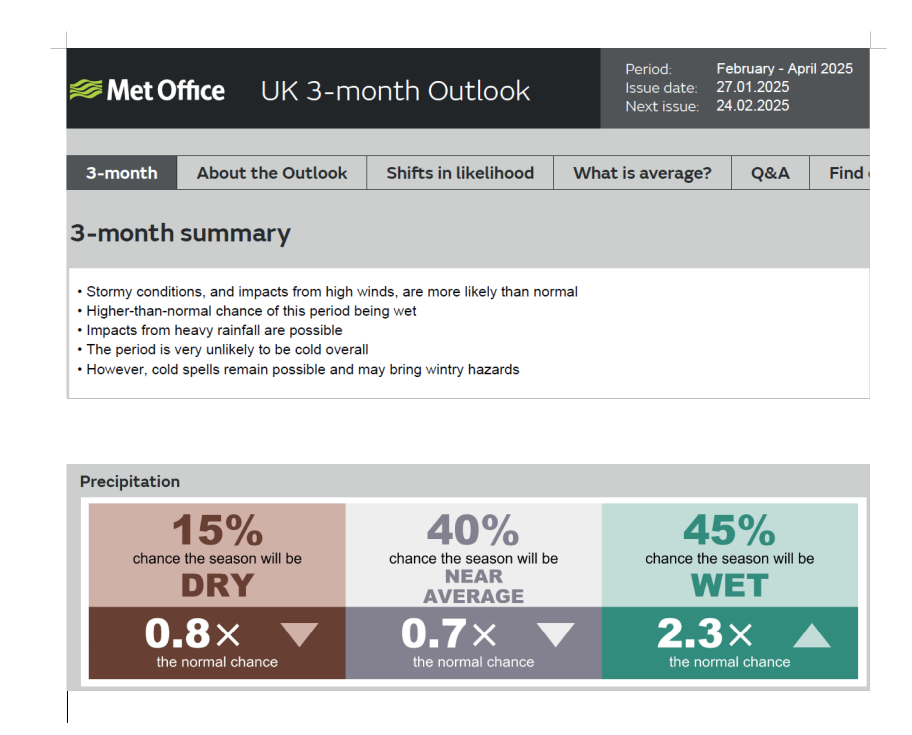

But what particularly stands out is the utter inability of the Met Office to foresee any of this happening. Their three-month Outlook, published on January 31, announced that the period would likely be wet and stormy, with only a small chance of it being drier than average!

These are the same clowns who think they know what the weather will be like in a hundred years.

They need to dump the climate hogwash and get back to their day job of forecasting the weather.

Starmer’s carbon tax betrayal

STARMER’S craven surrender to Brussels this week will have massive consequences in a number of areas, including free movement and rule-taking.

One aspect that has garnered less attention is the alignment of the UK Emission Trading Scheme (UK ETS) with the EU’s, of which we were a member prior to Brexit.

It all sounds a bit technical, but its immediate consequence will be to push up electricity prices, in clear contravention of Labour’s pre-election promise to cut energy bills.

The UK Emissions Trading Scheme (UK ETS) is a market-based system designed to reduce greenhouse gas emissions by setting a cap on total emissions. All major emitters of CO2, including power plants, heavy industry and domestic aviation, must have enough allowances to cover emissions. Allowances are sold at government auctions and the current market price is around £47/tonne of CO2.

As gas power stations have to pay this charge, it is passed on to customers, currently adding about 7 per cent to electricity retail prices, according to Bank of England analysis.

The EU’s carbon price is about a third higher than ours, so Starmer’s surrender will add more than a billion pounds to electricity bills, equivalent to £40 for every household in the country.

But the real threat is that we will no longer have any control over carbon prices. It has long been the plan both here and in the EU to continue pushing up carbon costs to squeeze out fossil fuels. UK government figures suggest they have been looking at tripling carbon prices in the next few years, pushing up power prices even more. But at least we can change course at elections.

Now we are going back to the EU ETS, we will have no say whatsoever. Remember that the whole logic of the ETS is artificially to make fossil fuels dearer, so that renewables can become competitive. If renewables really were cheaper, there would be no need for an Emissions Scheme.

So the inevitable result will be higher energy prices, one way or another. And it’s not just electricity, as industry will also have to pay the bill.

The tragedy is that the whole Emissions Trading Scheme should have been a golden opportunity to throw off the blanket of bureaucracy and regulation, setting the UK on a course to being a competitive economy again, as the Institute of Economic Affairs’ energy analyst Andy Mayer commented: ‘The smarter strategy would be to retain control of our own carbon policy, and cut it drastically to compete with the EU, encouraging jobs and growth.’

We should of course have done all this when we left the EU five years ago. Was not Brexit supposed to be all about getting rid of red tape and economy-killing regulation?