DONALD TRUMP has produced a veritable blizzard of trade tariffs across most industrial sectors and countries, rowing back, reducing, delaying and re-applying them, not so much where other countries have prejudiced US goods but where countries simply have a balance of payments surplus with the USA – or, in the case of the UK, even a deficit!

It has caused chaos for the massive integrated supply chains, mainly organised by American companies to buy cheap in China and Southeast Asia and sell products (like smart phones) expensively in the USA and Europe. The squeals of major American corporations (alongside rises in the cost of long-term US debt) have prompted the various Trump pauses and delays to some tariffs on most countries. China is the exception, where 145 per cent tariffs still apply – with more Trump exemptions for smartphones and computers, semiconductors, solar panels, flat-panel television displays, flash drives, memory cards and solid-state drives.

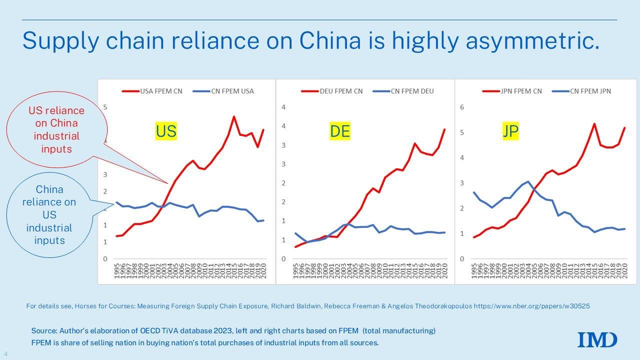

It might have been better to consult this table of the US and its allies’ industrial dependence on China before applying the tariffs. The graphs show US, German and Japanese dependence:

From October 14, Chinese-built and owned ships docking at US ports will be charged $50 per net ton, a rate that will increase by $30 a year over the next three years. 80 percent of world trade is transported by ship and the USA produces five such vessels a year while China produces 1,700. This is a classic demonstration of how turning around US production and trade weakness cannot respond to sudden changes in tariffs and boycotts, although the loss of critical imports on US domestic production is immediate.

Meanwhile, Trump has threatened new tariffs on pharmaceuticals and medical supplies, a critical area of UK exports to the USA. Positive words from US Vice President Vance and the advanced stage of US-UK trade talks might mitigate that threat to the UK, but the international threat remains critical for world trade.

Donald Trump has taken this sudden sledgehammer to crack a long-term nut, waging not so much a tariff war against unfair trade practices as an economic one against any country which has a trade surplus with the USA. The fallout has hit the US stock market (down some $11trillion since late January), US long-term debt and the level of the dollar against major currencies like the euro and the pound. Ironically, the biggest fall this year has been against the Russian ruble.The most significant signal of dollar weakness is the all-time high of $3,500 for gold.

Last week saw the biggest weekly fall in the 10-year US Treasury since 2001, and the biggest weekly fall in the 30-year Treasury since 1982. These are dangerous times for a high-stakes move with serious consequences for US consumers’ finances and Trump’s electoral support, not to mention complex international industrial and commercial supply chains – from parts for US iPhones and computers to rare earths (for which the USA relies 70 per cent on China, which in turn has 90 per cent of rare earth processing).

The US government also informed Nvidia, the world leader in AI computing, it would prohibit all future exports of its H2O chips to China, unless the company secures a special license. The company’s stock fell 6 per cent.Apple sells more than 220million iPhones a year, and nine in ten are made in China.

Trump raised the anti-China stakes even higher when he said the USA was negotiating with some 70 countries. He stated that, ‘we may want countries to choose between us or China’, in response to which China threatened countries not to disadvantage China in any trade deals with the USA.

Trump wants direct negotiations with the Chinese leader, but Beijing has suggested each side nominates an expert trade negotiator.

China has retaliated with 125 percent tariffs on US goods and has stopped importing US beef and liquified natural gas (LNG). It has also suspended exports of key rare earth metals (samarium, gadolinium, yttrium, and so on) and magnets (critical for the auto industry, the very sector Trump wanted US workers to take market share from foreign manufacturers) semiconductors, and the US defence industry.

The USA does have a genuine trade case against other countries.The EU’s ‘Fortress Europe’ tariffs are notorious with overt protectionism against food, agricultural products, cars and financial services. When the USA applied a 34 per cent tariff on Chinese goods, it roughly equated to the 35 per cent tariff which the EU applies to Chinese electric cars.

A study published by the National Bureau of Economic Research found that approximately 90 per cent of the drop in US exports to China during the first Trump term was due not to market forces, but unofficial non-tariff barriers. Such barriers include targeted subsidies to boost exports, excess production exported, state control of cheaper labour. Even today Chinese manufacturing labour at $15,000pa is far lower than US average manufacturing wages of $50,000. Then, there’s currency manipulation, technology theft, import administration, state-targeted import substitution, excessive technical standards and import quotas. To that must be added the (recently boosted) China ‘gray trade’, whereby Chinese goods are channelled through other SE Asian countries where they are re-packaged as local production to avoid US tariffs.

According to official data, China’s exports surged by 12.4 per cent in March, with exports to ASEAN increasing by 11.6 per cent and exports to Vietnam increasing nearly 19 per cent.

China’s leader Xi Jinping’s recent visits to Vietnam, Malaysia, and Cambodia could have secured their ‘gray trade’ hubs, but the USA has just imposed record high tariffs on Thailand, Malaysia, Cambodia and Vietnam, ranging from 41 per cent to 3,500 per cent.

However, the USA is not completely innocent with regards to non-tariff barriers (NTBs).

It is the 15th biggest user of them. In particular, ‘tariff rate quotas’ apply low tariffs but apply an import quota at that tariff to protect the domestic market. This is common in the agricultural sector behind which US agriculture shelters, maximising production to boost exports. In 2024, the USA exported $176bn in agricultural products, with nearly 50 per cent going to Mexico, Canada and China.

Yet in one critical area of trade manipulation, China has been pre-eminent: intellectual property theft, the long-term consequences of which can be world changing as whole areas of industrial innovation shift wealth creation and trade surpluses. Typically, either through imports of foreign technologies or joint ventures with Western high-tech firms, China has stolen the technologies and saved years of development risks and costs.

For instance, the US firm Westinghouse, one of the world’s leading nuclear power developers, undoubtedly had its technology stolen, whilst Japanese and European rail businesses have said that Chinese rail companies used technology from shared ventures to develop their high-speed rail business.

The Spanish wind power producer Gamesa was required to manufacture parts using Chinese domestic producers; within years, the same manufacturers produced parts for domestic producers who undercut Gamesa through favourable loans and state support.

There have been many examples of industrial espionage by Chinese students and workers in Western economies, helped by political and industrial naivety in, for example, the UK, and the USA. Other areas of industrial theft have been in the steel, aluminium and solar power industries. No wonder Trump has targeted tariffs at these sectors, albeit with a sledgehammer now hitting innocent allies as well as guilty foes.

The whole complex area of trade, tariffs, surpluses, deficits, geopolitical power struggles, free-trade economics, comparative advantage, sovereign independence, defence industry production and waging military and economic war have come together as President Trump disrupts the world ‘order’ in the hope that, as the dust settles and new trade deals are struck, it will be the USA who benefits most from the removal of unfair trade. But even if all trade disputes were settled tomorrow, it would still take years to invest in domestic production and change international supply chains. China’s dominance in rare earths, for instance, has taken 30 years to build.

Trump’s trade war is a justified gamble, but the issues are not black and white. Fair trade depends on mutual respect and trust. How much will remain after the deluge?