THERE is a reason the demand for Japanese bonds has plummeted: too much debt! Japan’s debt is larger than that of Greece. If Japan’s bond market comes under stress, Japan will become a forced seller of its US bond holdings to support its own markets.

The price and yield of US Treasury securities determine the interest rates consumers in the US pay for mortgages, auto loans, student loans, and credit card debt. Japan is the world’s fourth-largest economy. As Japan’s debt-saturated economy continues to deteriorate, it may soon be forced to sell US Treasurys, causing higher US interest rates, decreased consumer spending, and lower stock prices.

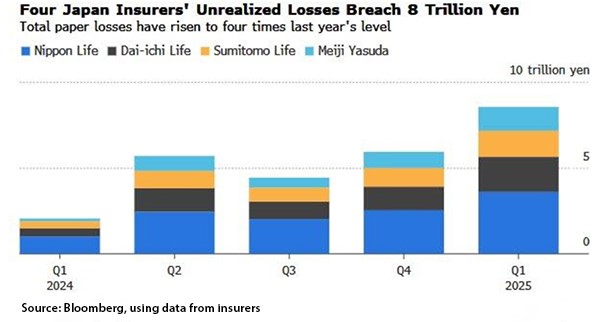

The recent buyer’s strike in Japan’s bond markets caused yields to soar to all-time highs: the 20-year yield reached 2.6 per cent (the highest since 2000), the 30-year yield climbed to 3.1 per cent, and the 40-year yield peaked at 3.7 per cent. This surge in record long-dated interest rates has resulted in massive pension fund losses on bonds held by Japanese insurance companies and other investor funds (see chart below).

The enormous losses prompted market participants to reassess their risk-reward trading profiles in Japanese Government Bonds (JGBs) holdings — and it’s only the beginning.

The Bank of Japan (BoJ), the country’s central bank, now owns over 52 per cent of all JGBs, making it the largest holder of Japan’s national debt. This is the unintended consequence of too much quantitative easing, or QE (money printing). This makes Japan’s debt larger than that of Greece.

Japan’s bond crisis resulted from a decade of policy missteps by Haruhiko Kuroda. Kuroda led the BoJ from 2013 to 2023, maintaining interest rates at unprecedentedly low levels for an extended time while utilizing QE to purchase bonds. Do these policies—QE and keeping rates too low for too long—sound familiar? Unfortunately, Federal Reserve Chairmen Alan Greenspan, Ben Bernanke, Jerome Powell, Janet Yellen and the US expert policy elites at the Fed, copied Japan’s approach.

One of Kuroda’s policies was featured on a 2015 cover of the Financial Times, above: ‘I trust that many of you are familiar with the story of Peter Pan, in which it says, the moment you doubt whether you can fly, you cease forever to be able to do it.’

I warned that Kuroda’s disastrous policy decisions as governor of the BoJ would trigger the next global credit crisis. The BoJ started unwinding its QE by raising interest rates for the first time in nearly 20 years, leading to a decline in confidence and trust in Japan’s finances.

In 2023, Kazuo Ueda, a lifelong academic, succeeded Kuroda at the helm of the BoJ after a decade of Kuroda’s failing to ever ‘fly’.

Moody’s missed the Great Financial Crisis and allegedly misled investors, resulting in a fine of $864million. Although the US downgrade was long overdue, it seemed politically motivated, appearing to be time itself to ‘blame Trump’. The US debt problems escalated further because of the Biden administration’s enormous spending. However, Japan’s debt is worse than Greece’s; Moody’s appears to have missed the boat again.

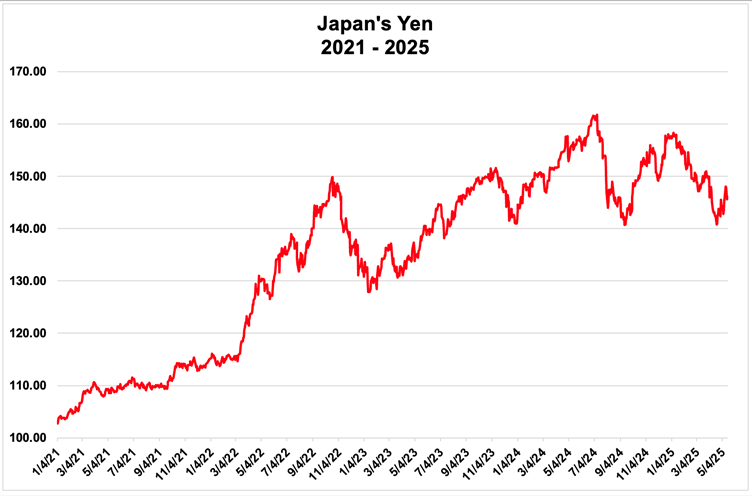

The above chart illustrates ‘a cautionary tale’ for the USA. It serves as a case study on the consequences of excessive national debt, highlighting the resulting decline. The Yen compared to the USD has lost over 50 per cent of its value in just two years, dropping from 103 to 157 (indicating a higher USD value relative to a lower JPY). The years of BoJ money printing have forced the Bank of Japan to make a difficult choice. I warned, ‘The BoJ can save their currency or their bond market, but not both.’ Lessons learned by the US Fed? None!

Japan’s excessive money printing has resulted in over four decades of economic stagnation. The attempts to ‘inflate’ away Japan’s debt through currency devaluations have made the BoJ the only buyer of JGBs. Consequently, distortions in the currency and bond markets have significantly undermined investor confidence.

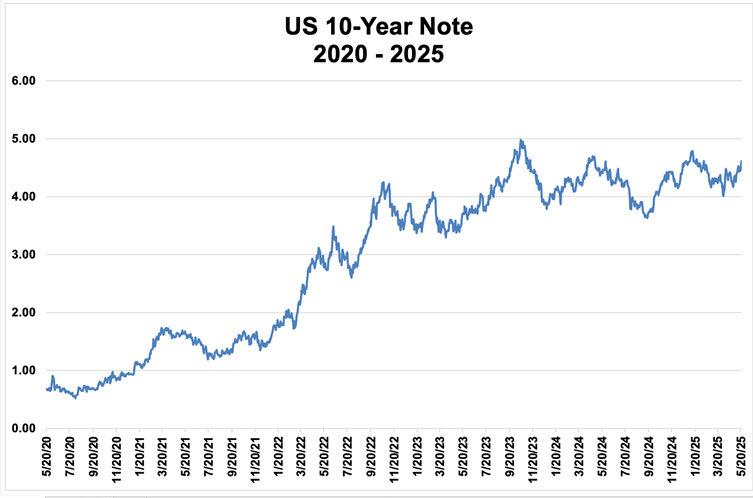

US 10-year note yields have recently traded higher, reaching 4.62 per cent, gradually rising from the April 4 low of 3.9 per cent due to a combination of Japan’s bond sales and the Fed’s politically motivated ‘wait-and-see’ narratives. The ‘uncertainty’ comments in the May 6-7 Fed policy minutes have tempered expectations for necessary rate cuts, despite Citibank’s consumer uncertainty index being lower than before the presidential elections, when the Fed cut rates by 50 basis points.

During Janet Yellen’s tenure as Biden’s US Treasury secretary, her most grotesque policy failure was to refinance our massive debt by buying shorter-dated bills and notes (chart above) instead of 10-year notes, which Yellen could have purchased below 1 per cent. Yellen’s refinancing mistake will cost US taxpayers between $500billion and $800billion.

The Federal Reserve has shifted public attention to an unquantifiable ‘uncertainty’ about Trump’s tariffs, which have not yet taken effect and may never happen. However, the Fed has overlooked mentioning how both Fed chairs’, Bernanke and Yellen’s, zero percent interest rate policies contributed to the trillions in outstanding non-performing debt in commercial and residential real estate, non-recourse loans, BBB, and high-yield bonds. Higher interest rates will increase credit events, including bond defaults and corporate bankruptcies.

Politics have driven the Fed’s most recent ‘wait-and-see’ policy. The recent ‘Fed speak’ and the 70-basis point interest rate increase will strain refinancing, limit growth, and undermine the economy’s main driver—consumer demand.

US stock markets are experiencing significant volatility and irrational exuberance. In April 2025, stock market capitalisations declined by over $5.5trillion from their record highs.

Since then, market caps and stocks have surged, especially following Wednesday’s:

1) Lawfare: A three-judge panel ruled that Trump overstepped his authority by imposing sweeping tariffs, cancelling President Trump’s tariffs, and ordering that the tariffs must be refunded.

2) Nvidia earnings, with Nvidia’s market cap nearing $4trillion (more than the annual GDP of both Germany and Japan), are once again booming toward stratospheric, unsustainable valuations, particularly among the magnificent seven tech stocks. Stocks are a sell on this news!

When markets fluctuate wildly, as we have seen since January, it serves as a warning—an extraordinary SELL signal indicating that something is seriously broken.

Meanwhile, the dishonest media will blame Trump; all facts, evidence, and data point to the Fed and BoJ’s decade-plus of misguided policies that have generated excessive debt, credit, and leverage. Beware, the big fat technology bubble is on the verge of bursting. Sell stocks now, as there will soon be other opportunities to create generational wealth.

This article was originally published in Newsmax and is reprinted here with kind permission.